With IDB support, Banco do Brasil qualifies for sustainable bond market

Banco do Brasil (BB), Latin America’s largest financial institution, completed its preparations to enter the market for sustainable bonds and has counted, for that, with the support of the Inter-American Development Bank (IDB). The objective is to seek the synergy between BB's experience in financin

Interview: IDB President

IDB Invest, Banco de Bogotá Announce First Sustainable, Subordinated Bond by a Colombian Bank

Green Bonds

The Brazil-UK Green Finance & Infrastructure Ecosystem Review: An Analysis of the Green Finance Capabilities and Policy Contexts in the UK and Brazil Markets, PDF, Infrastructure

Interview: IDB President

Valentina Marquez - Green Bonds - Connectivity Markets and Finance Division (CMF/IFD) - Inter-American Development Bank

Emerging market sustainable bond outlook remains constructive despite market headwinds

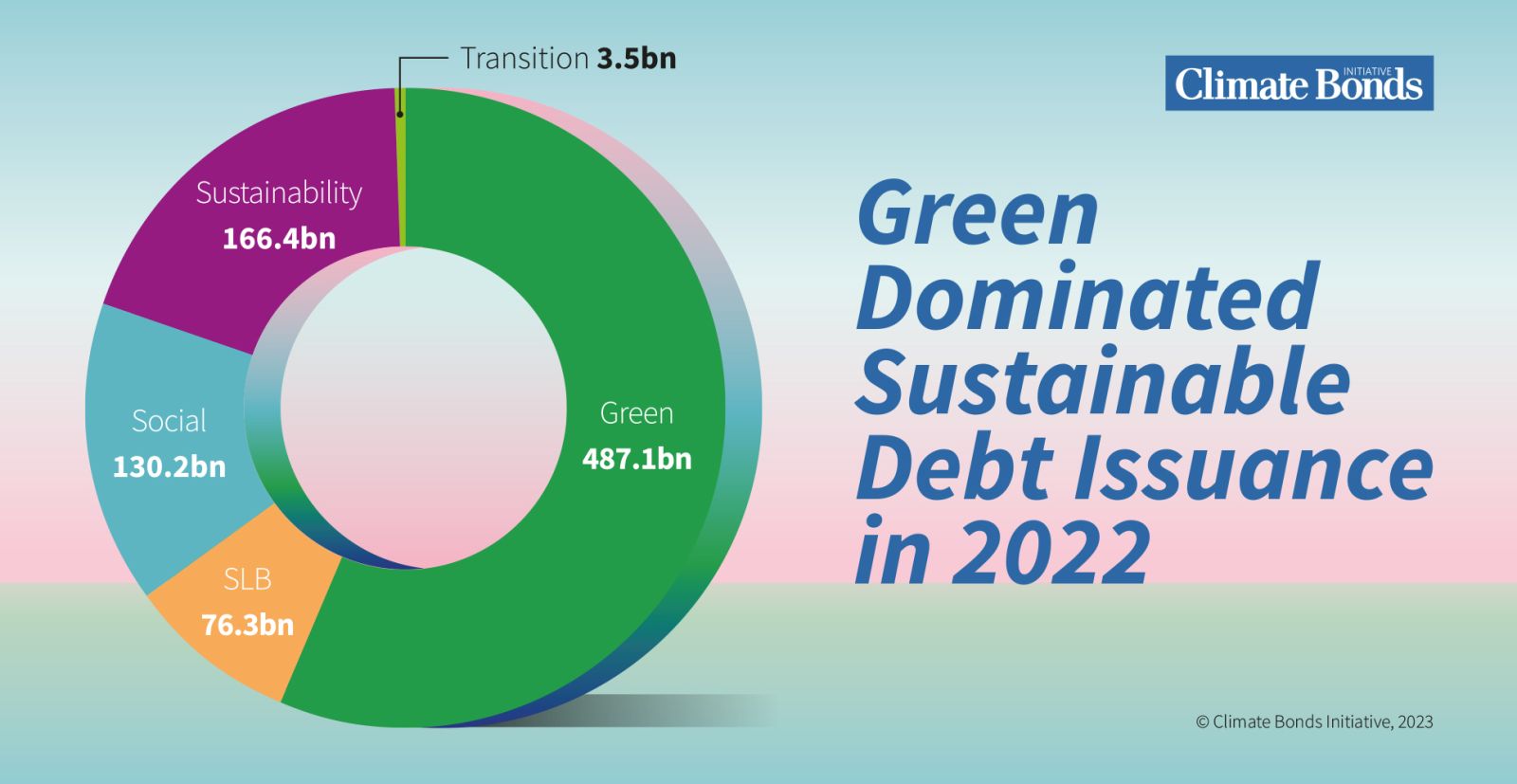

2022 Market Snapshot: And 5 big directions for sustainable finance in 2023

With IDB support, Banco do Brasil qualifies for sustainable bond market

bbd20120529_6k.htm - Generated by SEC Publisher for SEC Filing

Financial Integration in Latin America in: Policy Papers Volume 2016 Issue 023 (2016)

Brazilian-American Chamber of Commerce

Trade Capacity Building Resource Guide 2013 Vol. 1 by UNIDO - Issuu

Banco do Brasil issues 1st social bond as ESG wave seen to continue in 2022

inter-american development bank annual report 2003 by IDB - Issuu