Solution to VAT Requirements for Non-UK Resident Companies - Seller

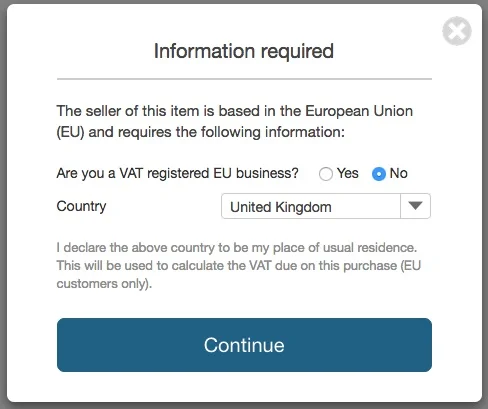

Introduction: In recent times, non-UK resident companies selling on have encountered a new challenge in the form of VAT requirements. is now asking these businesses to pay 20% VAT, regardless of whether they have crossed the sales threshold of £85,000.

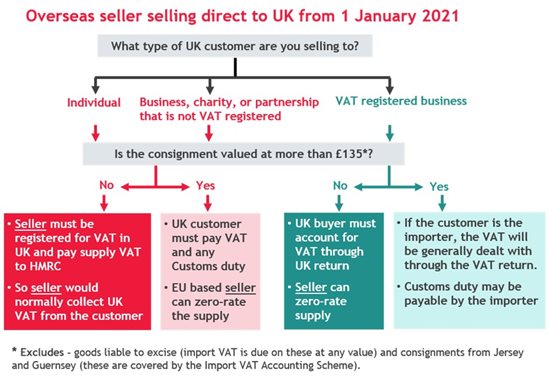

UNITED KINGDOM - Beginning 1 January 2021 - New rules for selling goods directly to UK customers - BDO

Not Completed A Deal On Pro Tools Expert? This Might Help

VAT Registration in France - Updated Guide 2024

How to check if a company is VAT registered

Guide on understanding VAT registration

Guidelines for payment for services in the UK or overseas

Netherlands VAT: Rates, Rules & Compliance

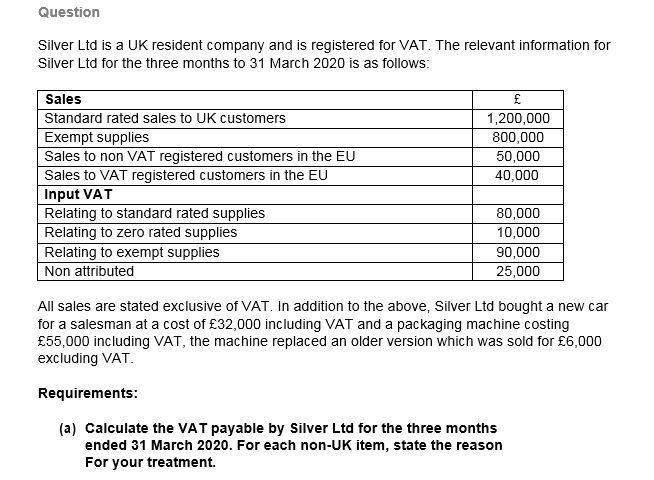

Solved Question Silver Ltd is a UK resident company and is

What is VAT Services all about

How to Sell on UK in 2022 - Jungle Scout

The Ultimate VAT Guide for Sellers in UK & Europe

New EU 2021 VAT Rules for Ecommerce - Shopify