Can you claim tax benefit for tax paid on insurance premium?, ET RISE MSME DAY

Section 80C and 80D of Income-tax Act entitles specified taxpayers to claim deductions for the entire amount paid to the insurance company for specified insurance schemes.

Tax Implications for Life Insurance Premiums as Collateral

Are Your Insurance Premiums Tax Deductible? - Merit Insurance Brokers

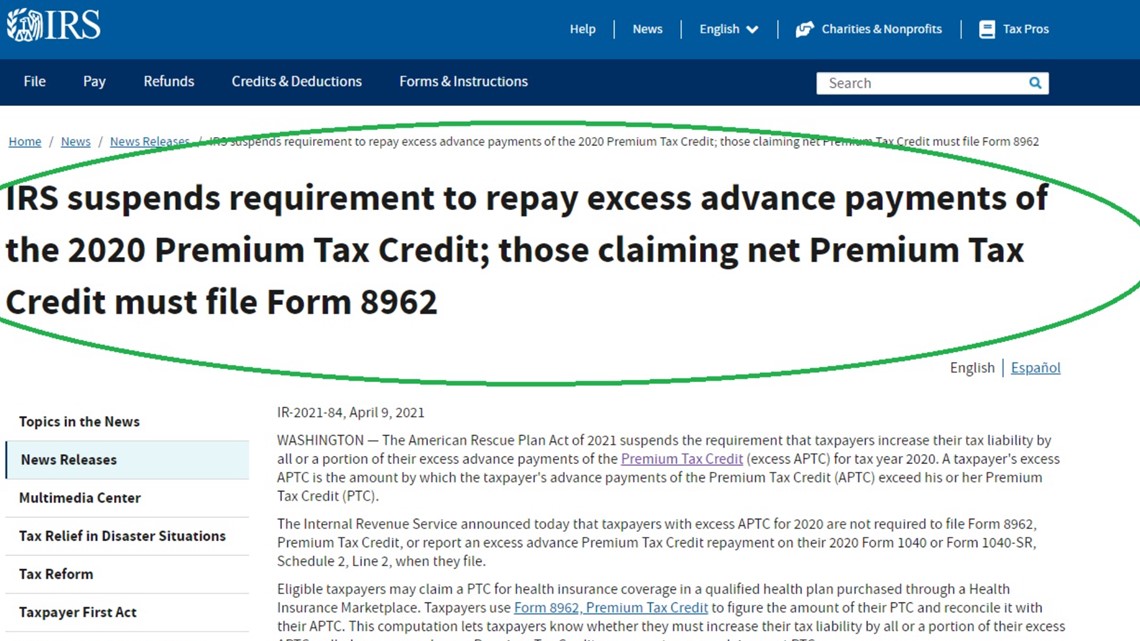

Do you have to pay tax penalties on your ACA healthcare this year

Are Insurance Premiums Tax Deductible?

Tax deductible personal health insurance in Ontario

7 Tax Credits & Expenses You Can Claim In 2023 That Could Save You Money When Filing - Narcity

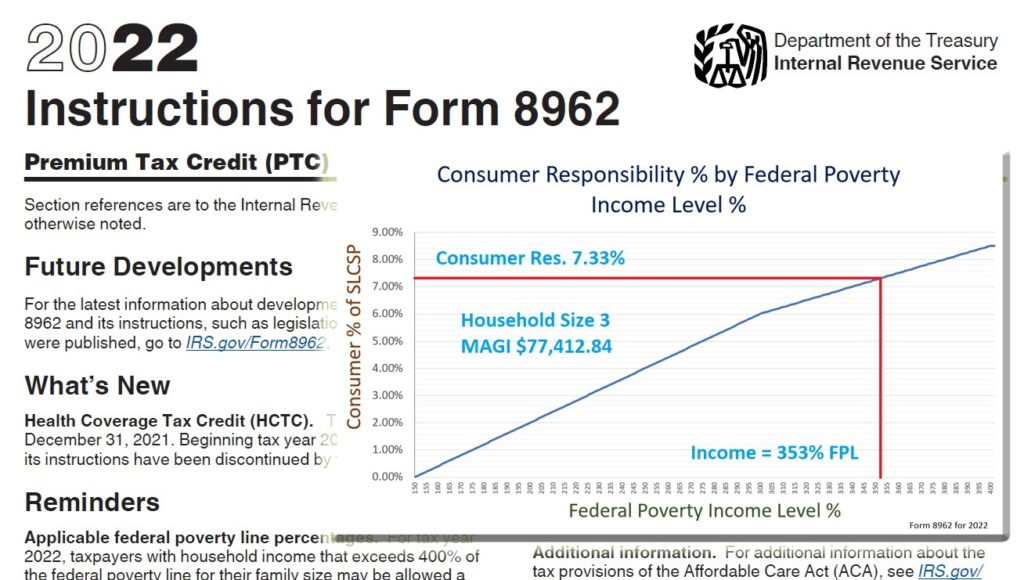

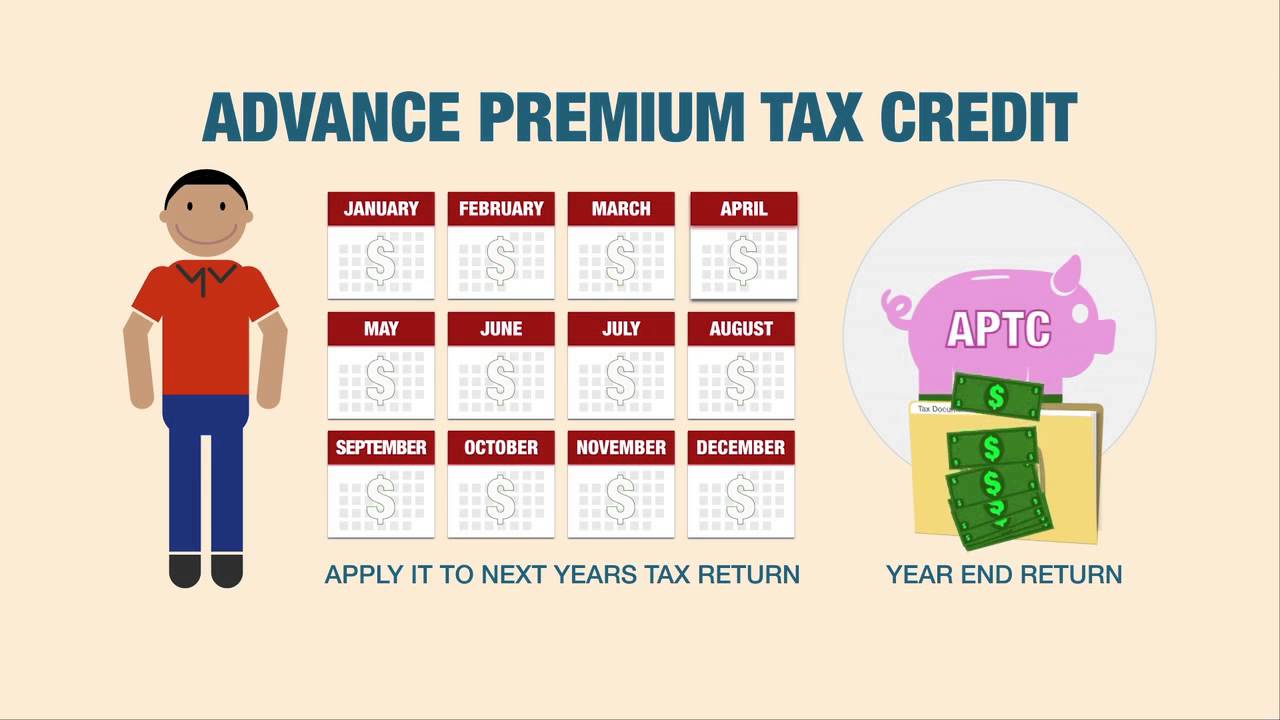

Tax Credit or Repayment? Health Insurance Subsidies for 2022

Tax Free Income for NRIs - Tax saving options for NRIs

ObamaCare Calculator: Subsidies, Tax Credits, Cost Assistance